for Equipment Financing & Leasing

Mulah provides tailored equipment financing and leasing solutions. Access the capital you need to purchase or lease essential equipment without draining your cash flow. From heavy machinery and vehicles to technology and tools, our flexible financing options and quick approvals help you secure the assets that drive productivity and growth. We understand the importance of keeping your business equipped and provide scalable solutions to match your needs today and into the future.

By clicking (Request Mulah) the submit button, you are giving express consent to be contacted via email, phone, and text, including your wireless phone number, using automated technology, regarding Mulah (MULAH.COM) products and services. Consent is not required to obtain goods or services and it can be withdrawn at any time. You also agree to the MULAH Privacy Policy. Message and data rates may apply.

Unlock Your Business Potential with Equipment Financing Solutions

At Mulah, we understand that acquiring new equipment is crucial for business growth. Our equipment financing solutions are designed to provide you with the necessary capital to purchase or lease equipment without depleting your cash reserves. Invest in your business’s future today with our flexible financing options.

Upgrade Your Technology

Expand Your Fleet

Acquire Essential Tools

Explore Our Diverse Equipment Financing Options Today

At Mulah, we understand that acquiring the right equipment is crucial for your business’s growth and success. That’s why we offer a wide range of financing solutions tailored to meet your specific needs. Whether you’re in manufacturing, transportation, or technology, we’ve got you covered. Let us help you get the equipment you need to thrive.

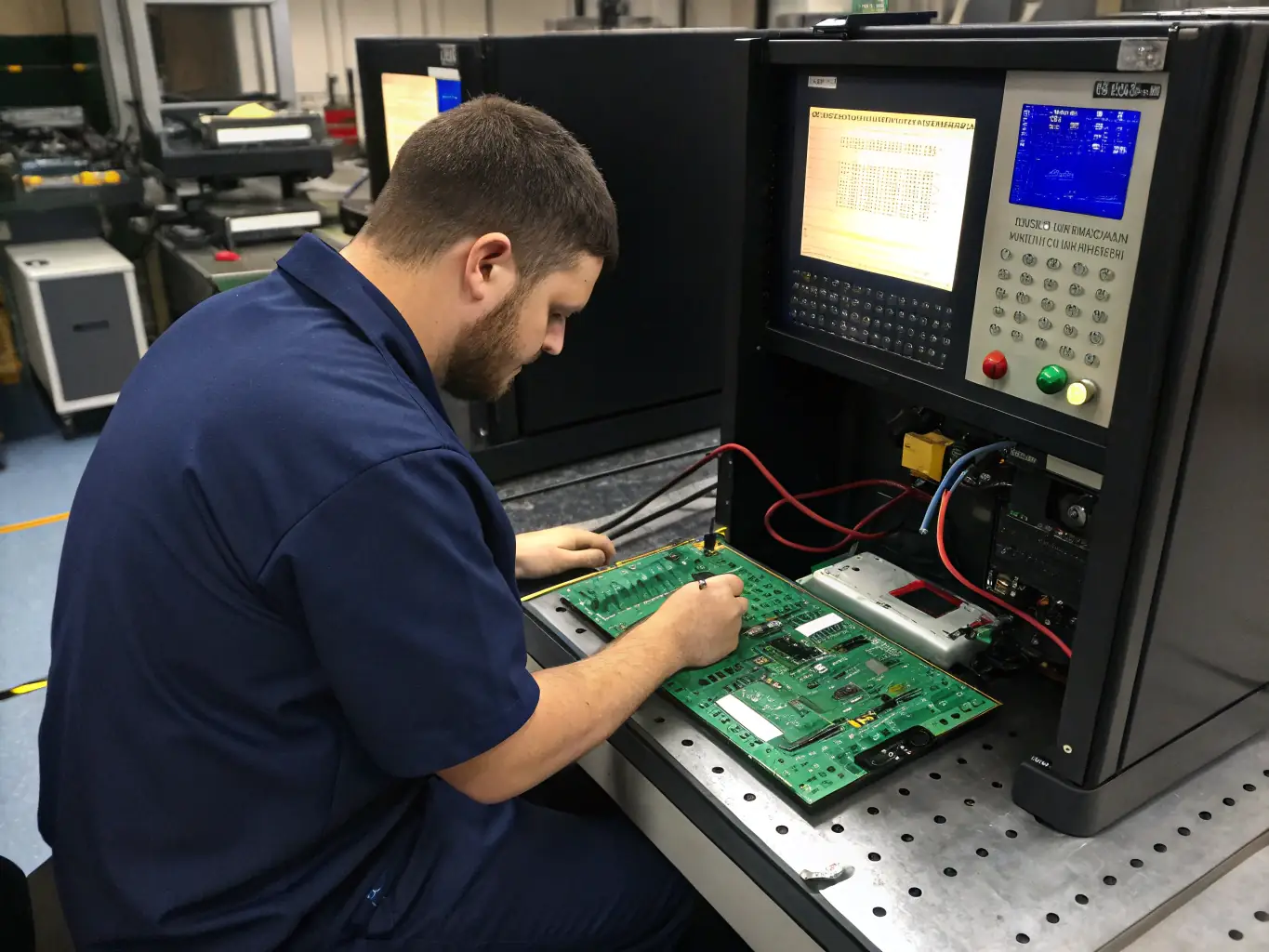

Manufacturing Machines

Commercial Vehicles

Tech Equipment

Understanding Equipment Financing with Mulah

Equipment financing allows your business to acquire essential equipment without significant upfront capital. At Mulah, we streamline this process, offering flexible financing solutions tailored to your needs. Here’s how it works:

- Application: Submit a simple online application with basic business information.

- Approval: Receive a quick decision, often within hours.

- Funding: Once approved, access the funds to purchase your equipment.

- Repayment: Repay the loan over a set period with manageable installments.

Benefits of Choosing Mulah

- Preserve Capital: Avoid large upfront costs, freeing up cash for other business needs.

- Flexible Terms: Tailored repayment plans to suit your cash flow.

- Quick Access: Fast approval and funding to get your equipment operational quickly.

- Tax Advantages: Potential tax deductions on interest payments.